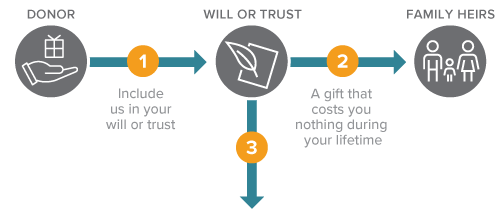

Gifts from Your Will or Trust

Need to preserve assets? You can plan a gift to us that will take effect only after your other obligations are fulfilled.

How It Works

- Include a gift to Philips Academy of NC in your will or trust. (Here is sample bequest language for your will.)

- Your bequest will support the overall mission of Philips Academy.

- Indicate that you would like a percentage of the balance remaining in your estate or trust, or indicate a specific amount.

- Tell us about your gift so we may celebrate your generosity now.

Benefits

- Your assets remain in your control during your lifetime.

- You can modify your gift to address changing circumstances.

- You can direct your gift to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

- Under current tax law, there is no upper limit on the estate tax deduction for your charitable bequests.

Please click here to let us know if you have already included Philips Academy of NC in your estate plan or if you are considering doing so. Thank you.

Please click here to let us know if you have already included Philips Academy of NC in your estate plan or if you are considering doing so. Thank you.

Next

- More detail about gifts from your will or trust.

- Frequently asked questions.

- Estate Planning Guide.

- Download: 25 Estate Documents You Need to Put in One Place.

- Contact us so we can assist you through every step.

Making a legacy gift to Philips Academy doesn’t take great wealth—just a sincere desire to have a positive impact on the lives of children with developmental disabilities. All gifts, large and small, are important to us and are very much appreciated.

By planning a legacy gift through a bequest in your will or a gift in your estate plan, you help ensure that Philips Academy will continue and that future generations of students will have access to a Real Learning for Real Life education.

If you’ve already included Philips Academy in your will or estate plan, let us know! We’d love to officially welcome you to the legacy society. However, should you wish to remain anonymous we are happy to honor that request.

- Margery and James Belisle

- Jane and Phil Blount

- Cathy and Steve Breeden

- Susie Crain

- Mary Daly

- Kristin and JD Downey

- Eldon Deweerth

- Nicki Engel

- Deborah and John Hofland

- Annette and Ed Imbrogno

- Jane and Frasier Ives

- Harry McNair

- Shannon and Graham Nice

- Fran and Jim Reichard